|

Westwood Aug. Meeting

Thursday, August 20, 2020, 7:30 AM - 9:00 AM PDT

Category: Westwood

2020 Tax Planning Ideas Join us at BP Westwood with Arnold Anisgarten, BP Board Member and managing member of Anisgarten Consulting. He will be discussing a wide range of topics including CARES Act tax changes, opportunity zone investment, like kind exchanges, deducting mortgage interest in excess of $750K loans, qualified small business stock, estate planning before yearend/after election, and possible retroactive repeal of net investment income Tax if Supreme Court overturns ACA, with opportunity for refunds from prior years. About the Speaker

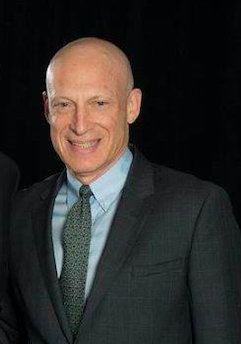

Arnold Anisgarten, CPA, was a tax partner with CohnReznick llp (and it’s predecessor firms) for over 35 years. He retired from public practice in January 2020. Arnold served primarily with the Private Client Services team at CohnReznick, providing tax and business consulting services to a wide variety of closely-held companies, their owners and high net worth individuals. He also had an extensive practice providing tax and planning services to real estate developers and syndicators. His specific areas of expertise have focused on entity structures, exit strategies, transactional planning and operational issues. During his career, Arnold successfully represented many clients regarding tax controversies during audits. With his ability to come up with solutions, he was often the first choice of many tax attorneys to assist their clients in dealing with government audits. Arnold was also highly involved in providing guidance and continuing education for CPAs at CohnReznick. Arnold began his career with a Big 8 accounting firm, working with middle market companies, high-net-worth individuals and not-for profit entities. An active member of the community, Arnold has served as a director for several not-for-profit organizations, including the Guardians of the Los Angeles Jewish Home, Hillel at UCLA, Bruin Professionals, Los Angeles Jewish Federation and the American Technion Society. For 20 years, Arnold chaired a pro bono tax preparation service for the Jewish Federation, preparing tax returns for recent immigrants to the United States. Arnold received a BA from UCLA and an MBA from USC, where he graduated Beta Gamma Sigma. Time will be set aside for attendee introductions, so using the video feature throughout the meeting is encouraged. The presentation will take place during the second half of the meeting. Please watch the training and read the documents on the BP ZOOM Resource Center, so you are prepared for the meeting. It is essential that you RSVP 24 hours in advance using the link below, so our Membership Coordinator can send you the meeting information promptly. Cost: Free RSVP Now!Contact: Bruce Berman | [email protected] |

Prev Month

Prev Month View Month

View Month Search

Search Go to Month

Go to Month Next Month

Next Month Arnold Anisgarten is now the managing member of Anisgarten Consulting, LLC, providing formation and operational consulting to start-up business. Arnold is known as the Solution Specialist.

Arnold Anisgarten is now the managing member of Anisgarten Consulting, LLC, providing formation and operational consulting to start-up business. Arnold is known as the Solution Specialist. Export Event

Export Event